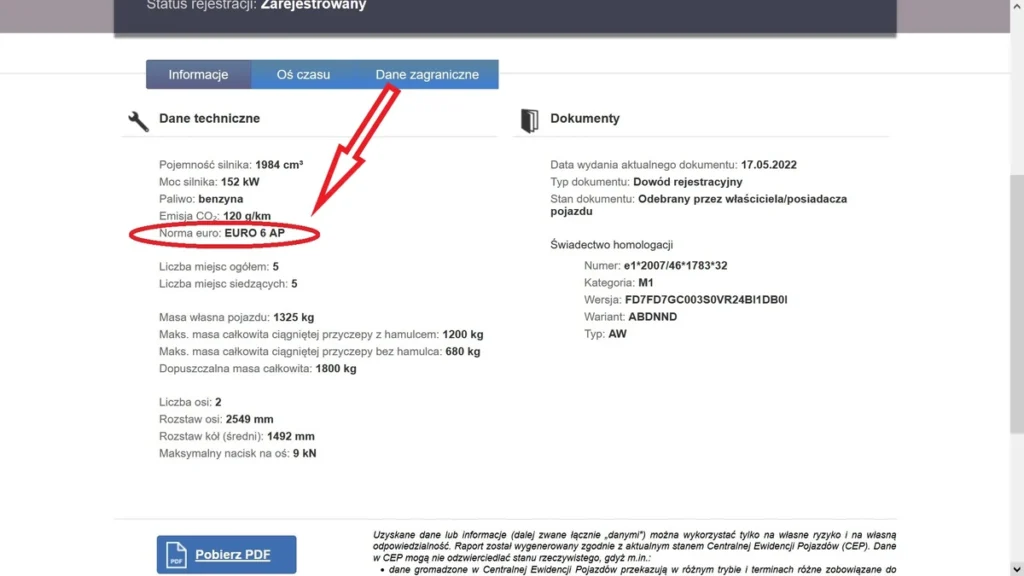

Polish tax authorities determine depreciation limits based on vehicle emission data from a national registry, ignoring manufacturer homologation figures.

Tax Deduction Limits

This is crucial for determining what portion of depreciation deductions for a passenger car or leasing installments a taxpayer can include in their revenue costs – whether calculated from the car’s value not exceeding 100,000 zł or 150,000 zł.

Emission Data Requirements

According to the director of the National Tax Information, entrepreneurs must take into account exhaust emissions based on data from the Central Vehicle and Driver Register, even if they are incorrect.

Ignoring Manufacturer Data

Data on carbon dioxide (CO2) emission levels contained in the homologation documents of a specific car are irrelevant for tax purposes.