Polish government proposes zero PIT tax relief for families with at least two children, including adult students, to take effect January 1, 2026.

Zero PIT Proposal for Families with Two+ Children

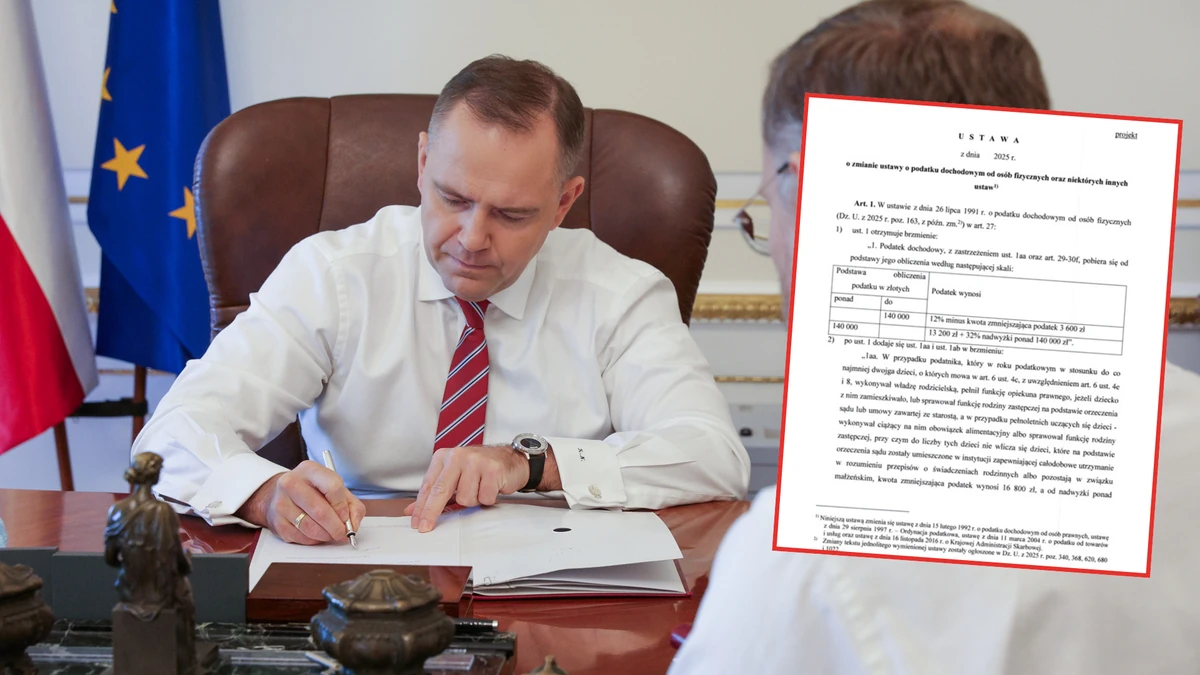

The project proposes a Zero PIT (Personal Income Tax) relief for families raising at least two children. The core change involves amending Article 27 of the PIT Act to establish a tax scale based on a threshold of 140,000 zł, with a 32% rate applying to amounts exceeding this threshold. For taxpayers raising at least two children, the project introduces an increased “tax-reducing amount” of 16,800 zł, which effectively creates a very high tax-free amount in the calculation, around 140,000 zł of taxable income, but only for families meeting the “2+” conditions.

Eligibility Criteria and Limitations

The project specifies who qualifies as a “child” for the relief: both minor children and adult children in education (generally up to age 25) or adult children receiving care allowance/disability pension or social pension. Direct exclusions are also stated: children placed by court order in institutions providing full-time maintenance or children in marriage are not counted toward the required number of children. An important limitation affects the highest-income taxpayers: preferences do not apply to persons obligated to pay the solidarity levy (for individuals with incomes exceeding 1 million zł).

Implementation Timeline and Additional Tax Measures

The project provides that the provisions in their new wording shall apply to income obtained from January 1, 2026. This is a key detail for families expecting quick effects in their wallets: even if the bill passed the legislative process, the first full annual calculation including the new mechanism would occur in the next tax year (i.e., in the return filed for 2026). The project also increases the rate of additional financial penalty from 10% to 20% in selected situations of income overestimation or loss reduction, which is intended to increase the financial risk of aggressive optimization.

Local Government Concerns and Cost Estimates

One axis of dispute concerns local government finances. In critical positions, the thesis appears that the relief constructed as a high tax-free amount for some taxpayers rewards households with higher incomes while potentially limiting public revenues – including those significant for local governments. In the public space, there are at least two levels of estimates: calculations indicating a revenue drop of around 13-14 billion zł versus figures suggesting even 30 billion zł annually as a possible cost for the budget.

Comparison with Existing Child Relief

Currently, the classic family relief operates in parallel. Today, a taxpayer deducts monthly 92.67 zł for the first child and 92.67 zł for the second child (so 1,112.04 zł annually), 166.67 zł for the third, and 225 zł for the fourth and each subsequent child. Income thresholds are also important with one child: for marriage throughout the year or single raising a child, the limit is 112,000 zł, while for parents not in marriage, it’s 56,000 zł. The “layering” of different relief systems has consequences: the more exceptions, limits, and dependencies, the greater the risk of interpretive disputes and the greater the role of tax authorities in verification.